Bankruptcies That Roiled Loyal Investors in H1 2025

High debt, production delays, brand irrelevance destroyed value in the first half of 2025

The first half of 2025 has seen an unprecedented surge in bankruptcies among multibillion-dollar companies globally. In USA alone, 188 large firms filed for bankruptcy—the fastest pace since 2010, according to S&P Global Market Intelligence. A cocktail of familiar balance-sheet destroyers have pushed even well-known names into financial distress.

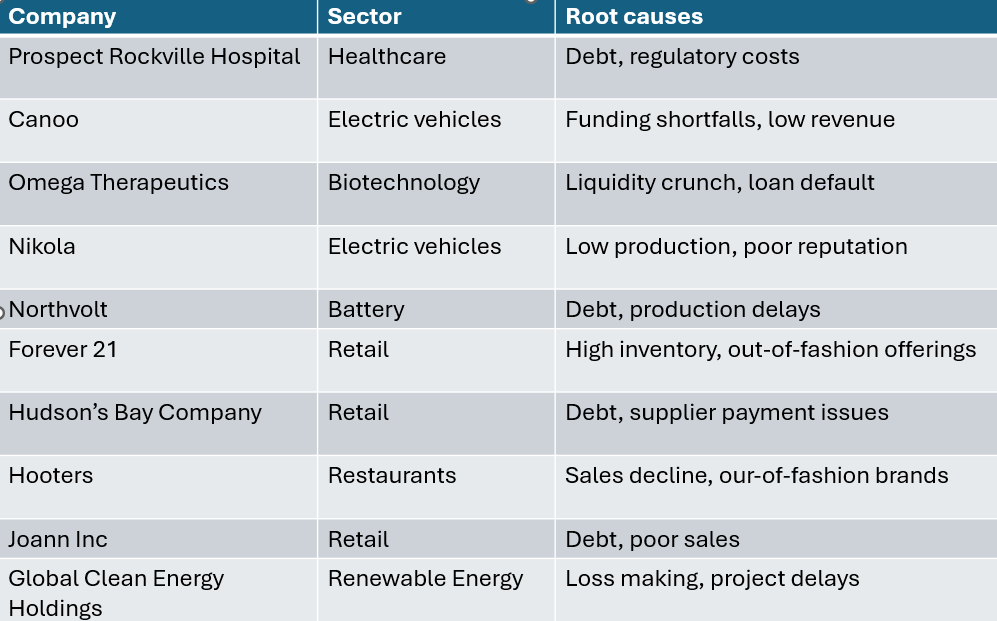

Retail, healthcare, and electric vehicle (EV) sectors were hit hardest. Companies like Forever 21, filing for Chapter 11 in March for the second time in six years, struggled with high inventory costs and failure to adapt to fast-changing fashion trends. In healthcare, Prospect Rockville Hospital’s January filing, with liabilities between $1 billion and $10 billion, underscored the sector’s challenges with rising operational costs and regulatory pressures. EV startups like Canoo and Nikola collapsed under funding shortages and production delays, unable to compete in a cooling market for electric vehicles.

Restaurants like Hooters faced declining sales as consumers shifted to trendier, healthier dining options, while rising labor and food costs squeezed margins. Renewable energy firms, such as Global Clean Energy Holdings, grappled with unprofitable projects and delays in a highly competitive market. These filings - see Table 1, for example, reflect broader economic pressures: high borrowing costs, operational ill-discipline, and a consumer base increasingly prioritizing value or experiences over traditional spending.

Table 1: A random list of 10 companies that went bankrupt in H1 2025.

Outlook for 2025

The bankruptcy wave is likely to persist through at least mid-2025, driven by sustained high interest rates and weakening consumer spending. Marginal businesses in Retail and Restaurants may face further closures as inflation worries continues to curb discretionary purchases. Healthcare and EV sectors could see more distress unless regulatory relief or renewed investor confidence materializes.

Companies with weak cash flows or heavy debt loads remain vulnerable, regardless of any potential ‘relief’ that may come through.