Beyond Raw Minerals: How Effective Are Strict Local Beneficiation Policies?

While strict policies yield mixed results, some enablers can unlock downstream value more consistently

Several resource-rich nations have imposed stringent rules to mandate local processing of minerals, aiming to capture more value domestically amid surging global demand for battery metals and clean-energy inputs, in addition to local pressures to boost prosperity for all citizens.

Indonesia’s 2014 ban on raw nickel and bauxite exports—phased in fully by 2023—requires all mining operations to include downstream refining, boosting its share of global nickel processing to over 50% and drawing $15 billion in investments. In Africa, Tanzania’s June 2025 reforms prohibit licenses for medium- and large-scale projects on 40 critical minerals without a local value-addition plan, while Zimbabwe’s 2023 Base Minerals Export Control Order enforces strict lithium processing quotas. South Africa mandates beneficiation under its Mining Charter, focusing on platinum and chrome, and the Democratic Republic of Congo is tightening traceability to curb raw cobalt outflows. Other adopters include Namibia, with export bans on unprocessed lithium, and emerging policies in Nigeria and Zambia targeting gold and copper.

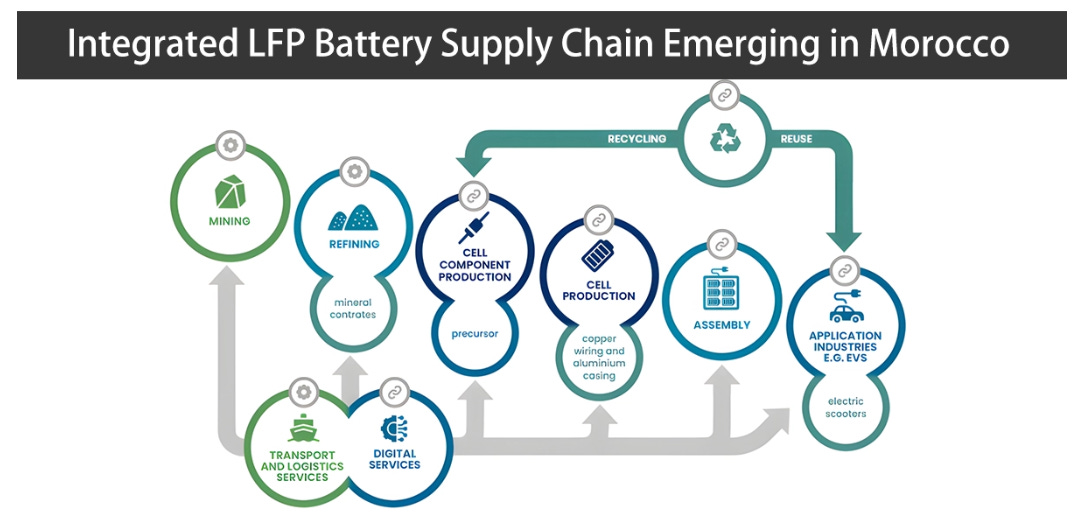

The measures above have driven mixed economic transformation. Indonesia’s nickel strategy added $10 billion to GDP in 2024 through job creation—over 100,000 positions in smelters—and spurred electric-vehicle battery manufacturing hubs, reducing reliance on raw exports by 40%. Morocco’s phosphate beneficiation via the state-owned miner, OCP Group, has generated $13 billion in annual revenues, fueling agricultural exports across Africa and lifting rural employment by 20%. Yet challenges persist: South Africa’s push has underdelivered, with beneficiation contributing just 2% to mining GDP due to high energy costs and skills gaps, exacerbating the “resource curse” where raw exports still dominate 80% of earnings.

In Zimbabwe, enforcement lapses and infrastructure deficits have limited lithium value-add to pilot projects, yielding minimal broad-based growth. It appears that strict rules accelerate industrialization in cases with scale—like Indonesia’s vast reserves—but falter without supportive ecosystems, sometimes amplifying inequality or environmental strain rather than fostering inclusive development.

Success in extracting value beyond raw shipments hinges on five core enablers:

Sufficient mineral scale ensures processing viability; Indonesia’s 21 million-ton nickel reserves underpin its smelter boom.

Reliable energy and logistics; Zambia’s grid upgrades for copper refineries cut costs by up to 30%.

Workforce upskilling via targeted training; Morocco’s skills development academies builds local expertise and sustains 70% domestic employment in value chains.

Transparent fiscal incentives, including tax breaks and joint ventures, de-risk investments; Tanzania’s 2025 reforms tie licenses to public-private partnerships.

Regional integration; The African Continental Free Trade Area pools markets and tech transfers, and has potential to unlock billions of dollars in annual African revenues by 2030.

Demand for critical minerals is expected to triple by mid-century. Well designed policies can can significantly increase the proportion of the population that benefits from these policies.