OpenAI's Circular Economy: Savvy Dealmaking or Systemic Risk?

Our loss-making AI darling has racked up > $1 trillion in circular financing deals with Big Tech, and may now be too big to fail.

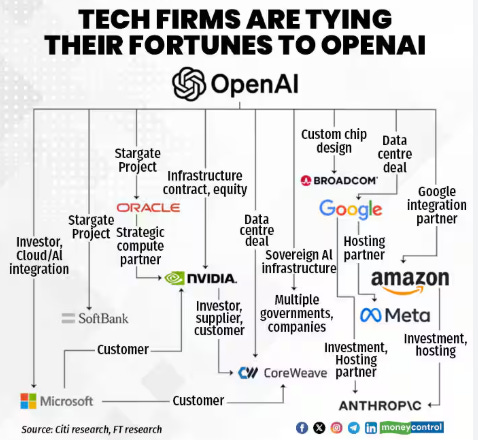

OpenAI, the force behind ChatGPT, has morphed from a research upstart into a dealmaking titan, weaving a complex web of partnerships with tech giants like Nvidia, AMD, Oracle, CoreWeave, Broadcom, Microsoft, and SoftBank. Some, like SoftBank, are even taking out margin loans to invest in Nvidia. These deals, totaling roughly $1 trillion in commitments for chips, data centers, and financing, form a circular economy where funds flow back and forth among players. OpenAI secures capital from suppliers, then funnels it back to buy their chips or infrastructure—a high-stakes cycle that could turbocharge AI innovation or unravel into a financial shock to the whole system.

The deals are dizzying.

In March, OpenAI signed a $11.9 billion, five-year cloud contract with CoreWeave, an Nvidia-backed startup supplying GPUs critical for AI training. CoreWeave, in turn, extended OpenAI $2.5 billion in credit to fund the deal.

In September, Oracle committed $300 billion over five years for the Stargate project, a $500 billion data-center venture co-funded by SoftBank, which provided OpenAI a $50 billion loan to secure its share.

Nvidia followed with a $100 billion data-center investment, partly financed by (or, to finance?) OpenAI’s purchase commitments.

AMD’s 6-gigawatt GPU deal included warrants for 10% of its shares, fueled by OpenAI’s upfront payments.

Broadcom’s October agreement to design OpenAI’s first in-house AI chips involves OpenAI funding production, targeting 10 gigawatts by 2026.

Microsoft, with $13 billion invested since 2019, continues to bankroll compute, bolstered by OpenAI’s $500 billion valuation—the highest for any private firm.

Proponents call this a masterstroke of vertical integration. OpenAI’s CEO Sam Altman argues that circular financing—where suppliers fund OpenAI, which then buys their goods—spreads the high AI compute cost ($50 billion to $60 billion per gigawatt) across a resilient ecosystem. Nvidia and AMD secure demand for chips, Oracle and CoreWeave gain long-term revenue, and OpenAI’s $4.5 billion in first-half 2025 revenue (up from near-zero in 2023) signals market traction.

“This is how we scale to AGI,” Altman said, framing the deals as a shared bet on AI’s future.

The playbook mirrors Apple’s supply-chain dominance, with circular cash flows ensuring mutual growth. Skeptics, however, see a house of cards. The $7.8 billion operating loss OpenAI posted in 2025’s first half highlights the risk: Circular financing ties suppliers’ health to OpenAI’s success. If AI adoption stalls or cheaper chips emerge, the cycle could collapse, leaving partners like Nvidia and AMD exposed.

OpenAI’s circular economy could redefine tech’s future. But when money loops from supplier to buyer and back, a single snag could unravel the whole thread.

However, unlike the .com bubble’s disastrous crash, an AI bubble crash, if it happens, is likely to be less severe as today’s tech giants actually have surplus cash.

OpenAI is now too big to fail. If trouble comes, it can always be propped up by its suppliers and forced to fake it until it makes it. In parallel, a slowdown could also be an opportunity for those playing catch-up to join the race at reasonable entry costs.