The Future of the Element with Atomic Number 51

Potential antimony supply crunch is both a risk and an opportunity

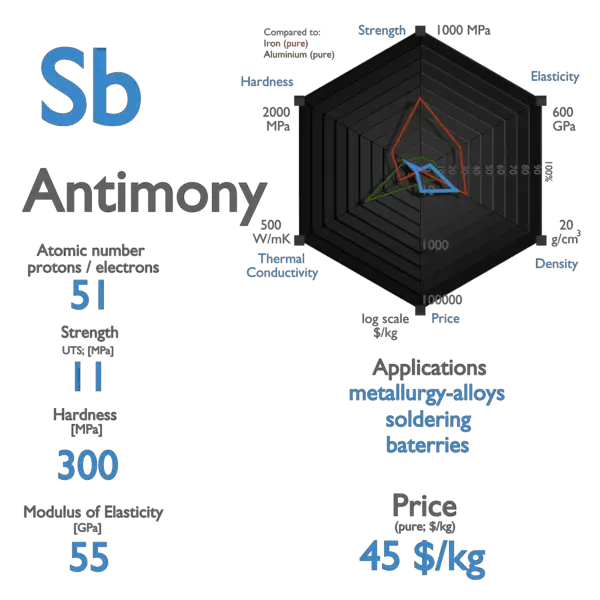

Antimony, a silvery metalloid with atomic number 51, is emerging as a linchpin in the global push for clean energy and defence technologies. Used in solar panels, batteries, flame retardants, and military applications, the demand for antimony is surging. The global antimony market, valued at $1.19 billion in 2023, is projected to hit $1.66 billion by 2030, growing at a 6.1% CAGR, driven by renewable energy and electronics.

China dominates the antimony market, producing 48% of the world’s 83,000-ton supply in 2023. However, export restrictions announced in September 2024, citing national security, have slashed global availability, pushing prices to a record $51,500 per ton in 2025, with some analysts forecasting a climb to $100,000. Hunan’s production halt for environmental inspections and declining ore grades in Myanmar and Vietnam further tighten the market.

Key Chinese players like Guangxi Huayuan Metal Chemical and Hsikwangshan Twinkling Star control much of the supply, while U.S.-based Perpetua Resources and Australia’s Larvotto Resources are ramping up exploration to counter China’s grip. The U.S., reliant on China for 63% of its antimony imports, faces national security risks, prompting a $15.5 million DoD grant to revive Idaho’s Stibnite Mine. Recycling is also a promising avenue to explore, but would need rapid scaling to have any impact.

Geopolitical tensions and environmental regulations pose risks, potentially driving prices higher and disrupting supply chains. Western efforts to diversify sourcing to Tajikistan and Australia may mitigate reliance on China, but scaling new mines will take years.

Where there is shortage, there is opportunity. The soaring demand for antimony offers investment potential, but limited investment instruments, e.g. exchange traded funds or derivatives, restrict access to antimony mining equities. The only options involve seeking direct participation in the metal’s production value chain.

As antimony’s strategic value grows, the search for economic participation can be worthwhile for patient stake-seekers, despite near term challenges of market volatility and geopolitics.