To Hedge or Not To Hedge: The Gold Miners' Question

Regardless of executives' fundamental views on the hedging question, it is simply irresponsible to not atleast open the question

With gold prices now hovering above $4,400 an ounce after a staggering 64% surge in 2025, mining executives face a perennial quandary: Should they lock in today’s lofty valuations through hedging, or bet on even brighter futures? Or is a project-based case by case approach more suitable? As analysts project prices climbing toward $5,000 by late 2026, driven by geopolitical tensions, Federal Reserve easing, and inflation fears, this debate is presumably raging on amongst traders and producers alike, from Toronto to Johannesburg.

Hedging, at its core, involves using financial instruments like futures or options contracts to secure fixed prices for future gold output. Proponents argue it’s a prudent shield against volatility. For companies burdened by debt or navigating high production costs, this stability can be a lifeline, enhancing borrowing capacity and protecting margins when prices dip. Yet history is littered with cautionary tales. A 2002 NYU Stern study found that heavy hedgers underperformed, as investors prize the upside volatility that gold stocks offer—essentially betting on the metal’s allure as a “safe haven” amid global risks.

Today, with gold’s bull run fuelled by central bank buying and portfolio diversification, many miners shun full hedging to capture potential gains. Forfeiting profits by hedging against a drop that never comes can put a CEO in hot water.

Enter the middle path: partial hedging, an approach where companies secure only a portion of output—say, 20% to 50%—balancing protection with opportunity. This approach suits varying risk profiles. For early-stage projects in exploration or development phases, hedging can de-risk financing, assuring lenders of revenue streams amid uncertain timelines. High-cost operators, vulnerable to energy spikes or labour inflation, might hedge aggressively to safeguard slim margins. Conversely, mature mines with low all-in sustaining costs (below $1,200 an ounce) and robust balance sheets can afford to ride the wave unhedged, leveraging strong cash reserves to weather downturns while reaping windfalls from price spikes. The reward calculus hinges on one’s gold outlook.

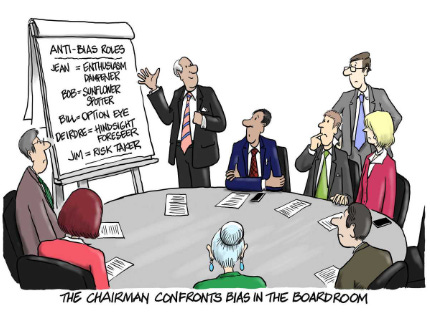

Basing the decision to hedge simply on whether one holds bearish or bullish views is dangerously simplistic. In this era of elevated uncertainty, the choice isn’t binary. It’s a tailored strategy, weighing project maturity, cost structures, and market winds.

Hedge smart, not hard.