Why Morocco Shines as Africa's Top Mining Destination

The continent’s future lies in digging smarter, not just deeper

Morocco stands tall as Africa’s most attractive mining hub, securing the top spot on the continent and 18th globally in the Fraser Institute’s 2024 Mining Survey, ahead of Botswana (20th), Zambia (28th), and Namibia (30th). Its winning formula—rich geology, smart policies, and strategic positioning—offers a masterclass for other African nations looking to cash in on their mineral wealth in the global green-tech-enabled mining boom.

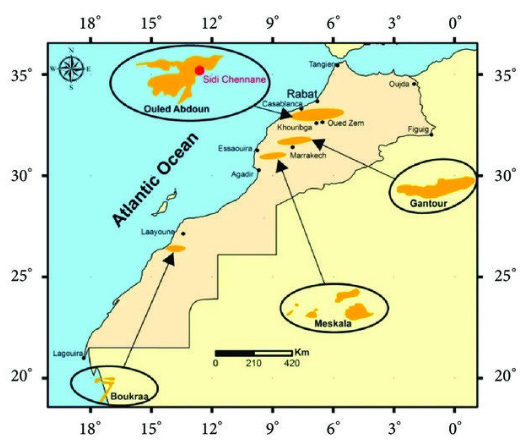

The kingdom’s geological edge in certain commodities is a sound base to grow from. Holding 75% of global phosphate reserves, Morocco is the world’s top exporter and third-largest producer, churning out 38 million tonnes annually. Beyond phosphates, it ranks high in silver and lead production, is Africa’s second-largest cobalt producer (798 tonnes in 2023), and struck gold with a 3-5 million ounce discovery in Guelmim in 2025. Mining drives 10% of GDP and 25% of exports, employing 39,000 with plans to add 30,000 jobs by tripling turnover to $1.5 billion by 2025. The numbers are smaller than some African countries, but the appeal as an investment magnet is much higher.

Morocco’s 2015 Mining Code offers permits up to 10 years, spurring $1 billion in exploration by 2021 (excluding phosphates). Nestled near Europe, it has much lower logistics costs, unlike landlocked peers like Zambia. Political stability—no coups or conflicts—and a 2025-2030 sustainability plan to cut emissions and water use, aligns well with EU standards, making it easier to secure loans-on-tap.

Domestic processing, led by OCP Group’s phosphate derivatives, adds value and jobs, unlike raw exports elsewhere in the continent.

Contrast this with others.

South Africa, with vast precious metals resources, ranks 58th globally due to energy crises costing $50 billion in 2023 and policy flip-flops. Zambia, producing 792,000 tonnes of copper in 2023 (4% of global supply), relies on mining for 70%+ of exports but is hampered by debt and weak infrastructure, ranking 28th. The DRC, with 48% of global cobalt reserves and 170,000 tonnes produced in 2023, drowns in instability and corruption, missing out on ethical sourcing deals despite $2 billion investments like Barrick’s Lumwana.

The sentiment that you have to be “tough and bold” to invest in Africa is not necessarily a good thing.

African nations can borrow Morocco’s playbook. The messages are:

(1) Reform laws for investor-friendly permits—Zambia’s 2023 changes boosted copper bids, but more needs to be done;

(2) Upgrade infrastructure—Morocco’s ports cut logistics costs 30%; South Africa could fix Transnet rail, Zambia the Lobito Corridor.

(3) Embrace ESG—Morocco’s OTC certification ensures traceability; DRC’s cobalt scandals cost billions.

(4) Promote local beneficiation—refineries could lift Zambia’s copper value by 20-50%, mirroring Morocco’s phosphate success.

Beyond geological and geographical gifts, Morocco’s attractiveness is grounded in stability and strategy. If Africa follows, it could unlock $200 billion yearly by 2030.

The continent’s future lies in digging smarter, not just deeper.